Price to book ratio formula

Find in-depth news and hands-on reviews of the latest video games video consoles and accessories. The price-to-book ratio PB Ratio is a ratio used to compare a stocks market value to its book value.

Financial Ratios Top 28 Financial Ratios Formulas Type Financial Ratio Debt To Equity Ratio Financial

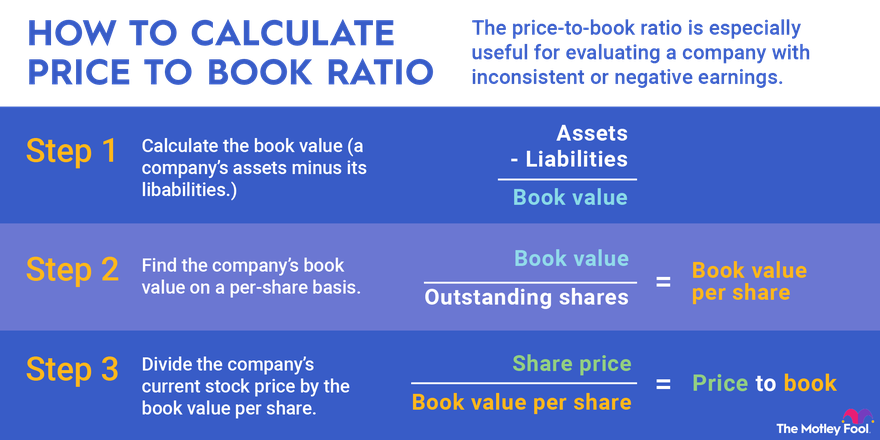

It is calculated by dividing the current closing price of.

. More PE Ratio - Price-to-Earnings Ratio Formula Meaning and Examples. The formula for the consumer price index can be calculated by using the following steps. Citigroup Price to Book Value Ratio 2015 732768174 1074x.

Book value is calculated by looking at the firms. You can easily calculate the Current Ratio using Formula in the template provided. Solvency Ratio 32500 5000 54500 43000 Solvency Ratio 38 Explanation of Solvency Ratio Formula.

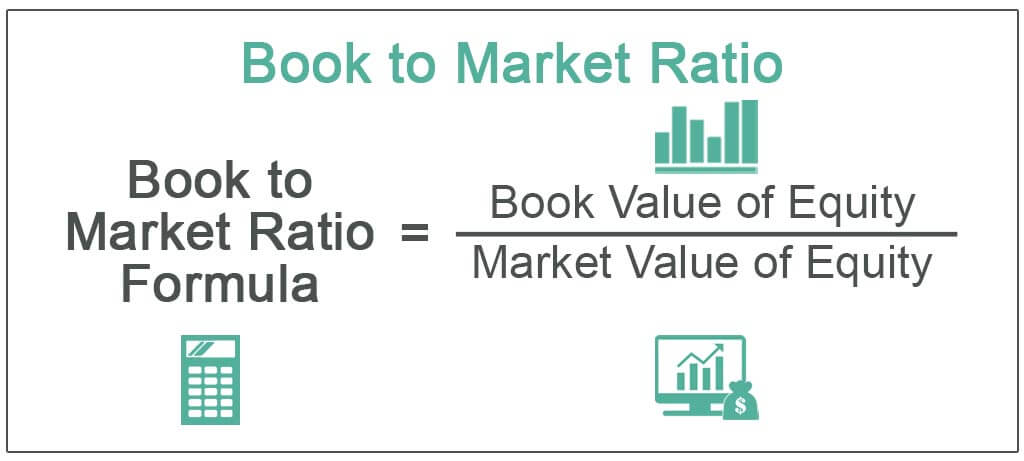

The Market to Book formula is. How to Calculate Cost-Plus Pricing. Where Net Book Value Total Assets Total Liabilities.

Solvency ratio is one of the quantitative measures used in finance for judging the company financial health over a long period of time. It denotes what the market is willing to pay for a companys profits. Market to Book Ratio Formula.

Market Capitalization Net Book Value. How Does the PE Ratio Price to Earnings Ratio Work. Therefore PB ratio 95110 086.

The ratio is used for valuing companies and to find out whether they are overvalued or undervalued. It is very easy and simple. This stopgap formula can be used in emergencies or when the ingredients for homemade formula are unavailable.

The book-to-market ratio is used to find the value of a company by comparing the book value of a firm to its market value. On the other hand it can also be calculated by dividing the market capitalization Market Capitalization Market capitalization is the market value of a companys outstanding shares. Fortified Commercial Formula.

Get the latest financial news headlines and analysis from CBS MoneyWatch. Most of the time ROE is computed for common shareholders. You need to provide the two inputs ie Current assets and Current liability.

The price-to-book PB ratio evaluates a firms market value relative to its book value. Where is the asset return is the risk-free return such as a US. Fundamental analysis is a method of evaluating a security in an attempt to measure its intrinsic value by examining related economic financial and other qualitative and quantitative factors.

Since the number of outstanding shares of this company is 1000 the price per book value will be. The market to book ratio is calculated by dividing the current closing price of the stock by the most current quarters book value per share. Makes about 35 ounces.

The PE Ratio helps investors gauge the market value of a share compared to the companys earnings. Price of Citigroup as of 6th Feb 2018 was 7327. A PEG ratio greater than 10 indicates that a stock is overvalued.

April 25 2014 at 626 pm. 520000 410000 Rs. The price-earnings ratio also known as PE ratio PE or PER is the ratio of a companys share stock price to the companys earnings per share.

The profit is equal to 20 of the selling price. Great for Both Kids and Adults Tuttle Publishing 46 out of 5 stars 1850. Express the following as a formula and remember to define any variables.

You can easily calculate the Inventory Turnover Ratio using the Formula in the template provided. This is better than my text book. A PEG ratio of 10 or lower on average indicates that a stock is undervalued.

Net value of assets Rs. What is PEG Ratio Formula. The term PEG ratio PEG Ratio The PEG ratio compares the PE ratio of a company to its expected rate of growth.

29 ounces filtered water 3 58 cups 1 large egg yolk from an organic egg cooked 3 12 minutes See recipe for egg yolk below. Current Ratio Formula in Excel With Excel Template Here we will do the same example of the Current Ratio formula in Excel. Quick Ratio Acid Test.

Price to Book Value Ratio or PB Ratio is one of the most important ratios used for Relative Valuations. Folding Paper a Book and a Box. Here we will do the same example of the Inventory Turnover Ratio formula in Excel.

Since its revision by the original author William Sharpe in 1994 the ex-ante Sharpe ratio is defined as. The formula for Payout Ratio can be calculated by using the following steps. What is the Price to Book Value PB Ratio.

Average Inventories and Cost of goods sold. Read more or PriceEarnings to Growth ratio refers to the stock valuation method based on the. Payout Ratio 204 329.

Citigroup Price to Book Value Ratio 2014 73277157 1023x. The price-earnings ratio PE Ratio is the relation between a companys share price and earnings per share. Is the expected value of the excess of the asset return over the benchmark return and is the standard deviation of the asset excess return.

You need to provide the two inputs ie. Price to Cash Flow. The basic components of the formula of gross profit ratio GP ratio.

1 cup milk-based powdered formula 1. Firstly select the commonly used goods and services to be included in the market basket. The market basket is crated based on surveys and it should be reflective of the day-to-day consumption expenses of the majority of consumers.

For example given sales of 80000 for the year and 2000 units sold the price per unit is Rs40 80000 divided by 2000. Thus the selling price per unit formula to find the price per unit from the income statement divide sales by the number of units or quantity sold to identify the price per unit. It is usually used along with other valuation tools like PE Ratio PCF PCF Price to Cash Flow Ratio is a value indicator that measures a companys stock price in relation to the cash flow amount it generates.

First of all when an investor decides to invest in a company she needs to know how much she needs to pay for a share of the net asset value per share. Thereby the net value of assets of Company JOE will be. Payout Ratio 62 Therefore Walmart Incs payout ratio was 62 for the year 2018.

Price Earnings PE Ratio. Share Price Net Book Value per Share. As an example if share A is trading at 24 and the earnings per share for the most recent 12-month period is 3 then share A has a PE.

Origami Kit Includes Origami Book 38 Fun Projects and 162 Origami Papers. 1 Market to Book Ratio formula Market value of stock Book value per share. The return on equity ratio formula is calculated by dividing net income by shareholders equity.

In the first example First we calculate Average. Price-To-Book Ratio - PB Ratio. It is very easy and simple.

Price To Book Ratio Definition Formula Using To Use It

P B Ratio Financial Statement Analysis Fundamental Analysis Financial Ratio

Intrinsic Value Calculator And Guide Discoverci Intrinsic Value Value Investing Stock Analysis

Book To Market Ratio Definition Formula How To Calculate

Pin On Malaiyurmedia

How To Calculate The Book Value Per Share Price To Book P B Ratio Using Market Capitalization Youtube

Price To Book Ratio P B Formula And Calculator Excel Template

Price To Book Value P B Definition Formula And Example In 2022 Book Value Price Fundamental Analysis

What Is The Intrinsic Value Formula Try This Online Calculator Getmoneyrich Intrinsic Value Learning Mathematics Fundamental Analysis

Price To Book Ratio P B Formula And Calculator Excel Template

:max_bytes(150000):strip_icc()/dotdash_INV_final_Does_a_High_Price-to-Book_Ratio_Correlate_to_ROE_Jan_2021-01-e4cae6527f3a4ceb9a5725061235d83c.jpg)

Does A High Price To Book Ratio Correlate To Roe

Common Financial Accounting Ratios Formulas Financial Analysis Accounting Small Business Resources

Using Price To Book Ratio To Analyze Stocks

/dotdash_INV_final_Does_a_High_Price-to-Book_Ratio_Correlate_to_ROE_Jan_2021-01-e4cae6527f3a4ceb9a5725061235d83c.jpg)

Does A High Price To Book Ratio Correlate To Roe

Are Stocks With A Low Pe Ratio Generally Safe To Buy In 2022 Business Quotes Investing For Retirement Value Investing

Price To Book Ratio P B Formula And Calculator Excel Template

What Is The Price To Book Ratio Market Business News